Calculating cost of goods sold (COGS) for products that you produce or sell can be difficult, depending on how many products are produced and how complex a production process is. Cost of goods sold, or COGS, is an activity and sales measure that defines the cost of the inventory sold (and created, if you are a producer) over a given period.

COGS, sometimes called the cost of goods sold, is reported in the business’s profit and loss account, directly below the line of revenue. Called cost of sales, COGS includes material and labour costs that are directly related to producing a retail item. In manufacturing, the cost of goods sold in the reported period includes finished goods inventories. In addition to inventories of raw materials, goods in-process, direct labour, and direct plant overhead costs.

Costs of goods sold (COGS) are the costs of procuring or producing products a business sells over the course of the period. And therefore, the only costs included in this measure are those that are directly related to producing a product, including labour, materials, and production overhead costs. For goods, these costs can include the variable costs involved in producing products, such as the raw materials and labour.

If your business makes things rather than sells them, that includes the costs of any raw materials or parts purchased for goods that are in inventory at the start of the year that are made into finished products, according to the I.R.S. It is important to track shipping costs and production costs per item. Which are added to inventory costs in a prior period. Identify raw materials start-up inventory, followed by working-in-process inventory. And finished goods, according to prior years year-end inventory amounts.

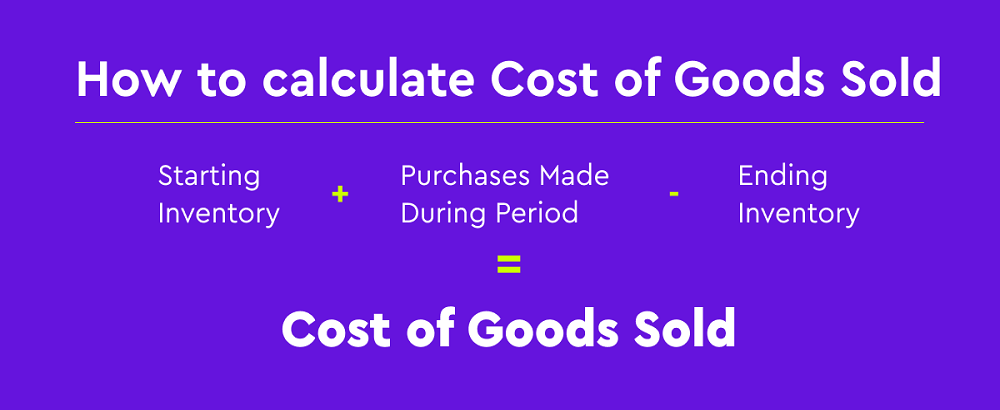

To keep records, the business must determine the cost of its inventory at the beginning and end of each fiscal year. If your business is newly established, then you can figure the value of inventory by its acquisition price, or using a formula for cost of goods. A simple formula for the cost of goods sold is to start with the cost of goods started. Add in any purchases or other costs, and subtract out your ending stockpile cost.

In the Inventory Weighted Average, the average prices of all products in inventory are used to estimate the value of goods sold, regardless of the date they were purchased.

The average value method is intended to remove the effects of inflation by pricing the inventory according to the average price of all goods in current inventory. Average cost method is when the business uses the average price of all goods in stock to compute its starting and ending inventory costs. The average cost method gives the unit cost, which is weighed by weight, which is applied to units that are available at end-of-period in closed inventory.

This is pretty self-explanatory, and involves taking the average cost for units of inventory sold. You then divide the dollar figure of the inventory by the units figure of the inventory to arrive at the average cost per unit. Your average cost per unit will be total inventory ($2,425) divided by total units (450).

This means that it costs $1,200,000 to manufacture the company’s total amount of packs sold in that month. Let us assume that it is a one-month period, and the company has an initial stockpile of backpacks that costs $1,000,000 to manufacture in materials and labour on the first day of the month.

The cost of goods sold includes not just the products that are in inventory to sell. But the labour that goes into producing and shipping them. And the parts and materials needed to manufacture them.

The cost of goods sold (COGS) is the aggregate of total direct costs incurred in relation to a good or service sold. And includes direct expenses such as raw materials costs, direct labour costs, and other direct costs. But it does not include all the indirect costs that the business incurs. Importantly, COGS is only based on costs directly used to generate revenue for a business, like a business inventories or the cost of labour which can be allocated to a particular sale. Calculations incorporate both direct costs as well as some of the indirect costs of specific manufacturing or sales activities, as defined under uniform capitalization rules.

The calculation of COGS is different because each expense is not simply added together. But instead, the starting balance is adjusted by cost of goods purchased and ending stock. If revenues are the total sales of the business products and services. COGS is the accrued costs of creating or purchasing these products.

Under FIFO, COGS is composed of finished inventory units produced first. Thus comprising costs incurred first, while under LIFO, COGS is composed of finished inventory units produced last, thus comprising costs incurred last, or more recently. If the firm orders a larger quantity of raw materials from suppliers. Then it is likely to be able to negotiate better prices, thereby reducing raw materials costs per unit produced (and thus COGS).

During periods when the costs of raw materials or labour are increasing. A FIFO approach will result in higher inventory per unit estimates for those items that are still on hand, relative to what was sold at an earlier point in time.

The Specific Identification Method uses specific costs for each unit of goods. Also called inventories or commodities, to compute end inventories and COGS for each period. In the case of physical goods, this typically includes the cost of existing inventory, plus any associated direct labour costs incurred during the year. Public companies are required by law to report their inventory costs in annual reports. So you can always check out a firm’s Cost of Goods Sold, or Cost of Sales, on a large US stock exchange.

If you have sales costs that are unique to the commodity. Such as fees, these costs may be included in COGS as well. COGS does not include indirect overhead costs. Common business expenses such as utilities, administrative and marketing costs, leasing and renting, depreciation, etc. Also excluded are costs to produce or buy goods that are not sold in any given financial period. And remain in inventory as finished goods.